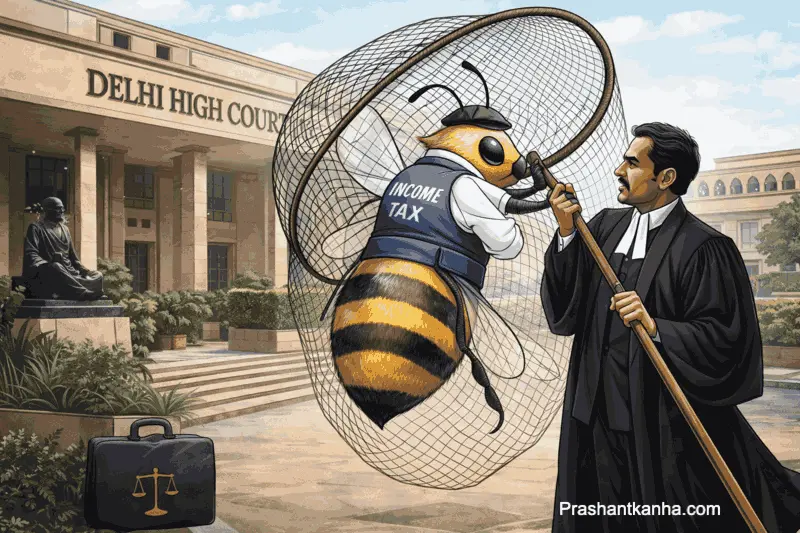

Quashing of Income Tax Reassessment under Section 148 by High Court

I. Introduction The power of the State to reopen concluded assessments and tax income that may have escaped the original assessment is one of the most potent and, consequently, one of the most contested aspects of the Income Tax Act, 1961. Sections 147, 148, 148A, 149, 150, and 151 of the Act collectively form the … Read more